The funding ratio is an important indicator for the financial situation of a pension fund. The funding ratio indicates the relationship between the assets of a pension fund and the current and future pension liabilities. In the case of a funding ratio of 100%, the pension fund has precisely the amount of money required to pay out all current and future pensions.

The policy funding ratio

The policy funding ratio is the average of the funding ratios over the past 12 months (the current (DNB) funding ratio). Consequently, the policy funding ratio provides insight into the financial situation of the pension fund over a longer period.

Funding ratios

-

119,4%

Policy funding ratio

-

120,2%

Current (DNB) funding ratio

-

March

End of month

Types of funding ratios

In addition to the current funding ratio and the policy funding ratio, there are other indicators of the fund's financial situation.

Required funding ratio

The required funding ratio indicates the minimum amount of money we need to have available to pay pensions now and in the future. If the policy funding ratio falls below the required funding ratio, we must submit a recovery plan to the regulator DNB. In such a plan, we have to indicate how we intend to achieve the required funding ratio within 10 years. The required funding ratio varies from one pension fund to another, and changes regularly. Bpf Koopvaardij's policy funding ratio at the end of 2022 was 123.1%, exceeding the required funding ratio of 111.5%. Bpf Koopvaardij does not currently have a recovery plan.

Contribution funding ratio

The contribution funding ratio shows whether the pension contribution paid jointly by the employer and employee is enough to fund new pension obligations.

Real funding ratio

For the real funding ratio, we take into account the expected rise in the cost of living. A real funding ratio of 100% means we can pay our pension liabilities and increase pensions by the expected rise in the cost of living. For more information about the real funding ratio, view our annual report (pdf page 5, Dutch only).

Investments

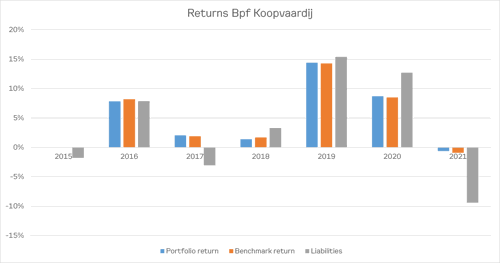

Bpf Koopvaardij invests the pension contributions. This is necessary in order to be able to pay out your pension benefits, because your pension consists largely of investment returns. In 2023, the return on investments was 8.2%. Pension liabilities - the pensions we have to pay out now and in the future - decreased by 6.5% in 2023. The graph shows the investment returns in the past few years.

Want to know more?

If so, visit Will your pension retain its value?, with information about the rise in the cost of living and your pension increase in the past few years. It also describes the situation in which a missed price indexation can be recovered.

Who is Bpf Koopvaardij?

Watch our video Who is Bpf Koopvaardij? to find out more about our organisation (2:01)